IFS ERP for CFOs: Driving 12% Margin Growth Through Data, Automation & Strategic Visibility

Table of Contents

ToggleThis article explores how IFS ERP for CFOs empowers finance leaders to go beyond cost-cutting and achieve sustainable margin improvement. By integrating operations, finance, and asset management, the IFS ERP solution delivers real-time visibility, automation, and measurable efficiency gains. Backed by Forrester’s TEI findings, it highlights how IFS Cloud ERP for CFOs reduces labour costs, lowers inventory expenses, and fuels smarter decision-making. And with expert IFS consultants and strong IFS ERP implementation, CFOs can transform financial management into a strategic engine for profitability.

Why Modern CFOs Need More Than Cost-Cutting

If you’re a CFO or finance leader, your daily challenge is clear: How do we improve profitability with discipline, precision, and agility? In today’s dynamic landscape, leveraging the right technology isn’t optional — it’s essential.

This is where IFS ERP for CFOs comes in.

This guide explores how IFS Cloud ERP drives margin uplift by aligning operations, finance, and strategy. You’ll learn the core IFS ERP benefits, how it strengthens IFS ERP for financial management, and why working with the right IFS ERP Consulting Service partners is critical for success.

Why Margin Improvement Requires More than Cost Reduction

Margin improvement isn’t only about trimming expenses. As a finance leader, your mandate is far broader:

- Reduce cost

- Release tied-up capital

- Optimise asset utilisation

- Shift resources toward higher-value activities

The IFS ERP system is built to support exactly that. With the right approach, IFS ERP for finance transformation becomes the backbone of a more profitable and scalable enterprise.

The Core Value Proposition of IFS ERP for Finance Leaders

At its core, IFS ERP for finance leaders provides a unified view across operations, asset management, service, supply chain, and finance. Independent reviews highlight that the IFS ERP system delivers:

- Real-time analytics

- Simplified processes

- Scalable, industry-ready architecture

One review notes that the platform “enables better communication, collaboration, and decision-making.”

IFS Cloud ERP enhances this with modern architecture, evergreen updates, flexible deployment, and modular design — empowering finance teams to lead transformation, not just manage transactions.

These IFS ERP benefits convert directly into cost savings, working-capital efficiencies, and measurable margin expansion.

Read more: Why an IFS Cloud ERP Upgrade is the Key to Scalable Business Growth?

Data-Backed Benefits CFOs Can Rely On

CFOs need quantifiable evidence before investing in any ERP transformation. Forrester’s TEI study of IFS Cloud ERP revealed:

- US$36.61M in total present-value benefits over 3 years

- US$18.5M in labour efficiencies

- 20% reduction in inventory carrying cost

- US$12.3M in capital cost savings from retiring legacy systems

Another analysis shows that IFS Cloud “integrates multiple business functions… enabling better decision-making, operational efficiency, and cost reduction.”

These validated levers allow CFOs to model margin impact — often revealing improvements well into double digits.

Read more: Why Global Enterprises Choose IFS ERP Over Legacy ERP

How IFS ERP Delivers Margin Uplift — The Mechanisms That Matter

Let’s break down how IFS ERP for profitability improvement actually drives measurable margin gains.

1. Labour & Operational Cost Reduction

With IFS ERP for finance transformation, automated workflows eliminate manual tasks such as reconciliation, reporting, and data entry.

The US$18.5M labour savings translates directly into improved operating margins.

2. Working Capital & Inventory Optimization

Excess inventory inflates COGS and ties up cash.

The 20% reduction in carrying costs delivered by IFS ERP implementation directly increases gross margin.

3. Better Asset Utilisation & Service Revenue Growth

For asset-heavy or service-driven businesses, IFS ERP for finance leaders connects service management, asset performance, and finance.

Better uptime → more revenue per asset → higher margins.

4. Real-Time Insights for Proactive Decision-Making

IFS ERP applications deliver immediate visibility across finance, operations, assets, and supply chain.

This prevents margin erosion through faster corrective action — a major improvement over legacy systems.

5. Scalable, Cost-Efficient Architecture

With IFS Cloud ERP, organizations avoid costly refresh cycles and reduce infrastructure overhead.

The US$12.3M efficiency gain in the TEI study reflects this margin impact.

Modeling Margin Improvement: A CFO’s View

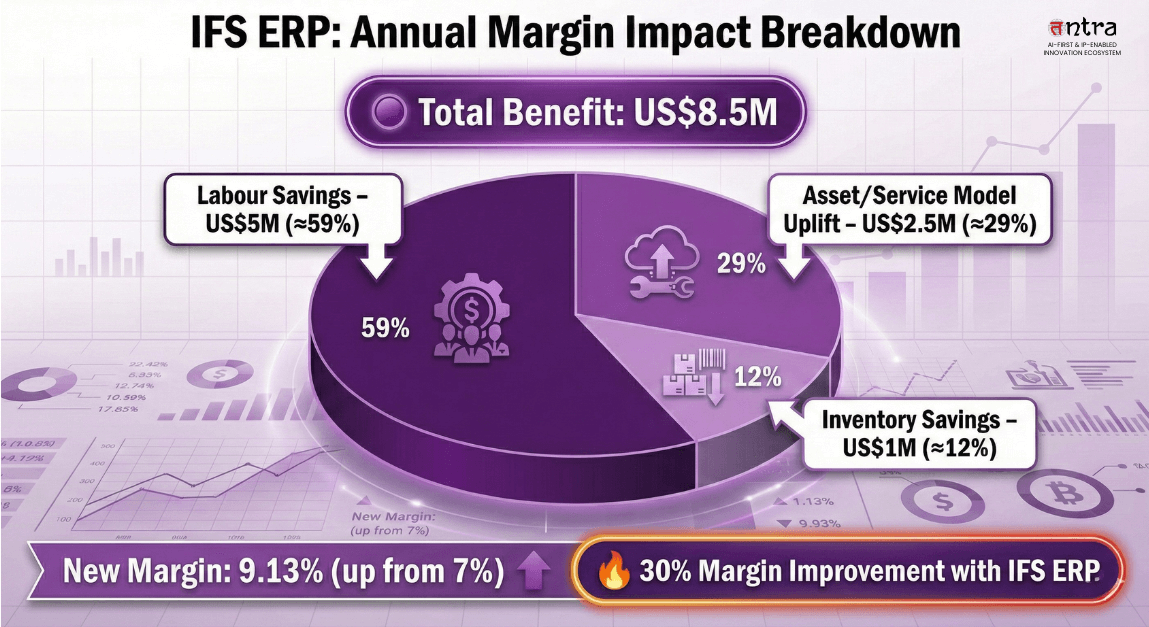

Here’s a simplified example showing how IFS ERP for financial management can improve margins.

Assumptions (your baseline):

- Revenue: US$400 million

- Operating margin (pre-ERP): 7% → Profit = US$28 million

Estimated benefits (post-IFS ERP implementation):

- Labour and overhead savings: US$5 million annually (modelled from the US$18.5M over 3 years figure)

- Inventory & working-capital savings: suppose inventory base US$50M, carrying cost 10% → cost US$5M; 20% reduction gives US$1M savings

- Additional revenue-or cost benefit (through asset/service model shift): US$2.5 million

Total incremental benefit: US$8.5 million annually

New profit: US$28 million + US$8.5 million = US$36.5 million

New margin: US$36.5 million ÷ US$400 million = 9.13%

That’s a margin increase of 2.13 percentage points, or ~30% relative improvement (9.13 ÷ 7.00 ≈ 1.30)

This is a 30% margin improvement, demonstrating how IFS ERP for CFOs unlocks measurable profit growth.

In other words, with disciplined use of IFS ERP for CFOs and the right supporting implementation, you end up with a meaningful margin improvement , and potentially well above the 10% threshold.

Read more: IFS Success Strategy: Support Innovation & Maximize ROI

Why Implementation Quality Defines Your Margin Outcome

Even the best ERP fails without the right delivery approach.

This is where IFS ERP consultants, IFS consulting services, and IFS ERP implementation services become critical.

Success depends on:

- Proper configuration

- Robust governance

- Strong change management

- Complete user adoption

Technology alone isn’t enough — execution determines ROI.

Five Actionable Steps CFOs Can Take Today

Use this checklist to maximise your IFS ERP benefits and unlock margin growth:

- Establish your financial baseline

Revenue, labour cost, inventory days, asset downtime, margin. - Map ERP impact levers

Align IFS ERP for profitability improvement with your revenue and cost structures. - Build a robust business-case model

Include risk adjustments and TEI-backed assumptions. - Secure strong implementation governance

Involve your IFS consultant early and define KPIs. - Track, measure, iterate

Use IFS Cloud ERP analytics to monitor impact and expand into new modules.

Common Pitfalls CFOs Should Avoid

- Treating ERP as an IT project rather than a profitability engine

- Underestimating adoption and training needs

- Focusing only on cost reduction

- Failing to track pre- and post-ERP metrics

Avoiding these pitfalls ensures your IFS ERP system delivers maximum value.

Why IFS Stands Out for Finance Leaders

IFS ERP for finance transformation is uniquely powerful because it integrates ERP, EAM, and service management into one data-driven platform.

IFS Cloud ERP delivers:

- Centralised data

- Real-time financial visibility

- Supply-chain optimisation

- Asset performance intelligence

It is purpose-built for complex industries — giving CFOs a strategic platform rather than a generic ERP.

Final Thoughts: Margin as a Strategic Outcome

If margin improvement is your priority, IFS ERP for CFOs offers a direct path to unlocking operational, working-capital, and revenue gains.

From cost efficiency and capital release to smarter decision-making, IFS ERP for financial management provides the strategic infrastructure finance leaders need.

With expert IFS ERP support services, continuous optimisation, and disciplined governance, CFOs can turn ERP investment into year-over-year profitability growth.

FAQs

1. What are the benefits of using IFS ERP?

IFS ERP streamlines operations, reduces costs, and improves decision-making with automation and real-time visibility. It unifies finance, supply chain, and service operations for smarter, faster, more profitable decisions.

2. What is the CFO’s role in ERP implementation?

CFOs align the ERP program with business goals, define ROI metrics, ensure governance, and champion adoption — all vital for profitability and efficiency gains.

3. How does ERP help finance teams achieve their goals?

ERP automates financial processes, provides real-time reporting, improves data accuracy, and supports strategic decisions through analytics.

4. How does financial data help increase profits?

Accurate financial insights uncover inefficiencies, cost patterns, pricing opportunities, and revenue trends — enabling better decisions that improve margins.

Related Articles

IFS ERP vs SAP – Manufacturing ERP Comparison

IFS Cloud Project-Based ERP Management

How IFS ERP for Manufacturing Powers the Future of Industry 4.0?