Powering Continuous IP for a Leading Middle Eastern Bank

- Industry: FinTech

- Location: Middle East

Introduction

One of the Middle East’s leading banks has long been recognized for its innovation-focused approach. But as the financial landscape continues to shift rapidly—with increasing focus on AI-driven services, ESG initiatives, and digital banking—the bank realized that true innovation isn’t just about building new products. It’s about building continuously, with IP as a core pillar of long-term strategy.

To help accelerate this journey, the bank partnered with Tntra to streamline their innovation engine, integrate IP into their product lifecycle, and build a more agile, scalable ecosystem for fintech transformation. This case study outlines how we collaborated to shape a future-ready, IP-oriented approach that supports their ongoing digital growth.

The Challenge

While the bank had a strong innovation track record and existing IP assets, it was seeking a more structured, time-efficient approach to:

- Evolving Innovation into IP More Effectively: Ongoing fintech initiatives—such as AI-enabled lending tools, customer engagement platforms, and ESG-focused applications—were being developed rapidly. However, turning these ideas into protected, monetizable IP consistently and quickly remained a challenge.

- Aligning Disconnected Transformation Streams: Various digital transformation projects—from regional expansions to core platform upgrades—were progressing in parallel. The bank needed a more unified innovation-to-IP process that could tie everything together while remaining adaptable to evolving market needs.

- Managing a Complex Innovation Ecosystem: With multiple internal teams, technology partners, and region-specific regulations, collaboration was becoming increasingly difficult. A central, collaborative model was required to coordinate efforts while allowing for flexibility and customization.

The Solution: Building a Continuous IP Engine with Tntra

We proposed a solution anchored in Tntra’s IP Practice, the T(u)LIP+ Incubator, and our customizable engineering and AI capabilities, tailored to meet the bank’s digital vision.

With our IP Practice, we didn’t reinvent the wheel. Instead, we enhanced the bank’s existing innovation streams with structured processes to identify, file, and manage IP efficiently.

- We started with a Patent Landscape Analysis to identify gaps and opportunities in emerging areas like AI in banking, ESG platforms, and personalized customer experiences.

- Our team built a Category Blueprint to align innovation efforts with long-term IP objectives.

- Through Innovation Discovery and targeted filings, we helped the bank bring structure to their IP creation process, cutting down time to file and protecting key fintech advancements.

This approach positioned the bank to continuously develop and safeguard IP that aligns with market shifts and their digital roadmap.

We introduced the bank to our T(u)LIP+ Incubator—a co-creation and innovation lifecycle platform that helps turn promising ideas into IP-backed solutions.

- T(u)LIP is designed to save time by embedding IP checkpoints directly into the innovation journey—from ideation to prototyping and go-to-market.

- The incubator is not designed for licensing, but offers a customized innovation process that supports ongoing development and scaling.

- Through focused sprints, the bank explored fintech opportunities around AI lending, ESG integration, and regional expansion strategies.

Within weeks, early-stage ideas had matured into deployable tools, now backed by a forward-looking IP strategy.

To bring these innovations to life, we deployed Tntra’s engineering teams along with Shruti AI—our modular platform for conversational and intelligent automation.

- Shruti AI was customized to the bank’s needs, helping implement automation in customer service, internal operations, and beyond.

- Our engineering capabilities supported secure, scalable development for domains such as payments, ESG finance, and digital onboarding.

- The focus was not on base-level tools, but collaborative engineering models tailored to the bank’s specific requirements.

This framework allowed for continuous delivery, ensuring that every rollout was aligned with their business objectives and ready for IP protection.

The Outcomes

In less than a year of collaboration with Tntra, the bank saw outcomes that far surpassed their initial innovation goals—transforming IP into a driver of both revenue and market expansion.

Financial and Strategic Impact

- Enterprise Value Growth: Increased from €40–50 billion to over €180 billion post-IP integration.

- Licensing Revenue Boost: Jumped from under €0.1 billion to over €2.2 billion through monetization of fintech IP.

- Annual Revenue Uplift: Rose from €30–40 billion to €139.7 billion, significantly aided by IP-backed digital products and partnerships.

- Return on IP Investment: ROI on IP initiatives surged to 10.5%, up from an earlier estimate of 5%.

Tactical Benefits Realized

- Profitability: IP-driven initiatives—such as AI-based predictive analytics and digital onboarding tools—enabled €1.2 billion in annual licensing and reduced tech downtime by over 40%.

- Customer Satisfaction: 20% improvement in customer engagement and efficiency due to smart metering-like systems adapted for digital banking.

- Service Differentiation: Integration of AI-backed risk modeling and blockchain-based financial instruments created a defensible competitive moat.

Global Market Expansion

- Licensing & Export Opportunities: IP-backed innovations opened up cross-border licensing opportunities in Asia and North Africa, while enabling joint ventures with regional fintech startups.

- International Growth: Accelerated expansion into new markets aligned with digital strategy blueprints, mirroring initiatives like UAE's Smart Finance Vision 2030.

Comparative Advantage Secured

By adopting an IP-first approach:

- The bank transitioned from a product-centric model to a technology licensing strategy, inspired by global leaders like EDF.

- Positioned itself as a strategic enabler in fintech ecosystems, with IP forming the backbone of monetization, risk reduction, and regional expansion.

Looking Ahead: Unlocking Strategic Advantage with Strong Force

As part of the journey, we introduced the bank to Strong Force IP Portfolios—a curated IP stack of over 450 patents across AI, enterprise software, and automation. This offered:

- Access to strategic licensing opportunities

- A future-ready investment lens on their IP assets

- Insight into cross-industry technology trends shaping the future of financial services

Through this, the bank gained a clearer view of how to turn not just ideas—but IP-backed innovation—into a long-term competitive edge.

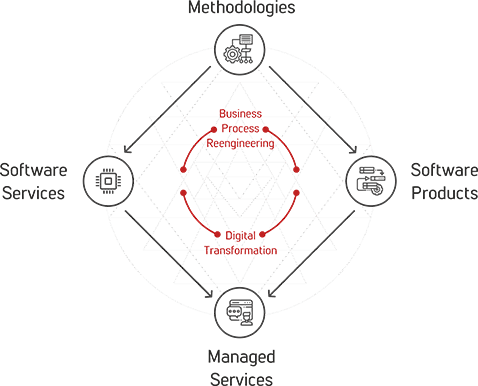

Tntra Diamond

Tntra's Diamond is a comprehensive approach to helping enterprises manage the constant interplay between Business Process Reengineering and Digital Transformation. Tntra’s domain specific methodologies lead to software services for mature systems and software product engineering for new requirements, further transitioning to a managed service model to ensure stability and scale.

Tntra's Diamond enables the enterprise to stay ahead of the transformation curve, while at the same time ensuring optimal business processes to meet the needs of the new economy.