Banking Competition 2025: FinTech, Technology, and the New Rules of Financial Services

Table of Contents

ToggleThe world of banking is changing – and the competition in banking sector is rewriting the rulebook. With rising banking industry competition from FinTechs, tech companies, and evolving market demands, traditional banks must rethink everything. This article breaks down how banking market trends 2025, the rise of FinTech, and shifting customer expectations are driving transformation. Learn why success now depends on bold moves, seamless customer experience, and embracing technology trends shaping the future of the financial services competition. Continue reading to learn more.

If you walked into a bank ten years ago, you’d see business ticking along, steady and predictable. Today? That scene has completely changed.

There’s a sense of urgency – almost a quiet scramble.

Because the competition in banking sector isn’t just rising… it’s exploding.

Banks aren’t just competing with other banks anymore. They’re up against tech giants, FinTech startups, and even e-commerce platforms.

Everyone wants in on the financial services game, and they’re coming in fast, armed with technology and customer-focused solutions that are turning the industry upside down.

And here’s the thing: this isn’t a passing phase.

The banking industry competition has shifted for good.

What’s Driving the Escalating Banking Industry Competition?

Let’s break it down. The rise in banking industry competition isn’t random. It’s been driven by a few major shifts that have changed the game:

1. Customers Want More – and They Want It Now

People expect their banking experience to be as smooth as ordering food online.

No waiting. No complicated forms. No jargon.

And if a bank can’t deliver that? Customers move on.

2. Technology Opened the Floodgates

The rise of mobile apps, digital wallets, AI-powered services, and cloud platforms means even a small startup can offer services that rival a big bank.

The result? Financial markets competition is fierce – and wide open.

3. Regulations Made It Easier for New Players

With Open Banking and similar laws, new players now have access to customer data (with permission), leveling the playing field like never before.

4. Data Became the Ultimate Power Move

Whoever knows their customers better – wins.

Banks that leverage customer insights are pulling ahead in the escalating financial markets competition.

The Crowded Banking Competitive Landscape: Who’s In the Game Now?

The banking competitive landscape used to be simple – just banks.

Now? It looks more like a tech startup expo.

- Big Tech: Apple, Google, Amazon – they’re all offering financial products now.

- Neobanks: No branches, fully digital, laser-focused on user experience.

- Retail Giants & Platforms: Adding payment options, wallets, loans, and even investment products.

The fight for market share has never been more intense – and it’s redefining the banking competitive landscape.

Smart Moves: Competitive Strategies in Banking that Actually Work

So how are banks responding to this rising storm of banking industry competition?

The leaders are adapting with bold competitive strategies in banking, like:

- Building Platforms, Not Just Banks

Banks are moving beyond offering products. They’re becoming service platforms – offering everything from payments to insurance to investments in one seamless experience.

- Personalization That Actually Feels Personal

Thanks to better data, banks are creating experiences tailored to individual customers.

It’s one of the smartest competitive strategies in banking – and it’s working.

- Partnering Instead of Competing

Many banks are collaborating with FinTechs rather than fighting them.

Together, they’re creating innovative solutions that benefit customers – and help them survive in the competitive world of financial services competition.

- Upgrading Tech to Keep Up

Banks are ditching outdated systems for modern, flexible tech that lets them move faster and serve customers better – key to surviving the banking competitive landscape.

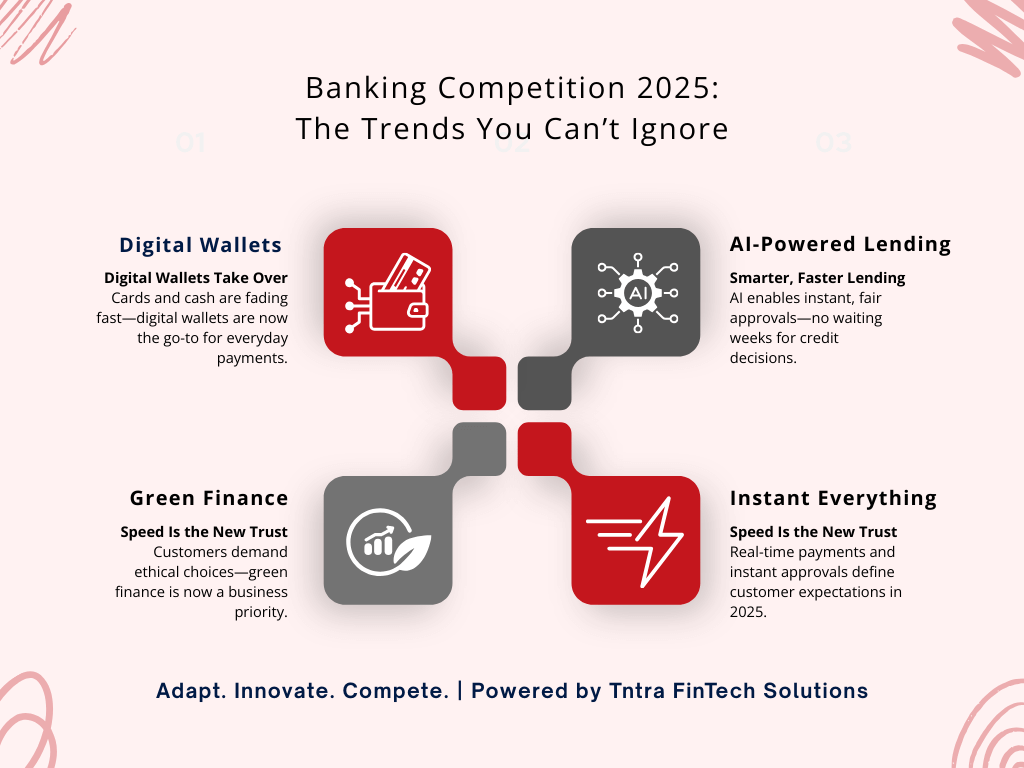

The Top Banking Market Trends 2025 You Can’t Afford to Ignore

The future isn’t around the corner – it’s already here.

And the banking market trends 2025 are shaping the way forward.

- Digital Wallets Are Dominating

People are leaving their cards – and cash – behind. Digital wallets are becoming the go-to for daily payments. - AI-Powered Lending is Mainstream

Banks are using smart tech to make faster, fairer credit decisions. - Green Finance is a Big Deal

Sustainability is now a business priority. Banks are investing in ethical, green finance because customers care. - Instant Everything

Real-time payments, instant loan approvals – customers expect things to happen now. And banks that deliver will lead the future of banking competition.

The Real Battle: The Future of Banking Competition will be Won on Experience

Forget low fees and better rates for a moment.

The future of banking competition will be won by those who can deliver a standout customer experience.

Customers want to feel understood, valued, and supported – not treated like account numbers.

If a traditional bank can’t offer that?

There’s a fintech or tech company ready to take their place.

The Global Heat: Financial Markets Competition Around the World

Look beyond your local branch, and you’ll see the financial markets competition playing out on a global scale:

- Asia-Pacific: Super apps combining social, payments, and shopping – completely reshaping how people bank.

- Europe: Open Banking laws have unleashed a wave of fintech creativity.

- Africa & Middle East: Mobile-first banking is breaking barriers, bringing financial services to millions.

No region is immune to this shift – and the financial markets competition is only getting stronger.

The Danger of Sitting Still in a Changing Market

History’s full of once-great companies that refused to change until it was too late.

Kodak. Nokia. Blockbuster.

Banks that think they can ignore the competition will end up in the same category.

Because the reality is, the banking industry competition isn’t waiting around for anyone.

How Banks Can Actually Win: Facing the Rising Fintech Competition in Banking

It’s not about panicking. It’s about pivoting.

The rise of fintech competition in banking has shown that customers value speed, convenience, and genuine service over tradition.

Here’s what banks need to focus on:

Real Digital Transformation in Banking

Throwing up a mobile app doesn’t count as transformation.

Digital transformation in banking means:

- Replacing clunky systems with modern platforms.

- Automating tasks to serve customers faster.

- Creating seamless experiences across branches, apps, and online.

- Empowering teams to experiment and innovate.

It’s a cultural shift – and it’s essential for banks to survive against FinTech competition in banking.

What Gives Real Competitive Advantage for Banks in Today’s Market?

It’s a mix of speed, trust, and relevance.

The new formula for competitive advantage for banks looks like this:

- Be fast – but build trust with transparency.

- Use data wisely – but never forget the human touch.

- Innovate – but solve real customer problems, not gimmicks.

That’s what separates leaders from followers in today’s financial services competition.

Retail Banking Competition: What Customers Expect Now

The retail banking competition isn’t about offering the lowest rates or flashiest ads anymore.

Customers want:

- Real guidance with their money.

- Support when it matters most.

- A partner in their financial journey – not just a service provider.

Banks that deliver on these expectations will win the retail banking competition.

The Shift in Corporate Banking Market Trends

Corporate clients are seeing big changes too. The corporate banking market trends shaping today include:

- Real-time cash flow management.

- Blockchain-enabled cross-border payments.

- Embedded lending solutions for business platforms.

These shifts are changing the game in corporate banking – and smart banks are already adapting.

Why Customer Experience in Banking is the Ultimate Game Changer

At the heart of everything is this: customer experience in banking matters more than ever.

When customers feel valued and supported, they stay.

When they don’t – they leave.

It’s really that simple.

- Fast, friendly service.

- Personalized advice.

- Tools that actually help.

- Support when they need it, where they need it.

Get this right – and you’re winning the financial services competition without even trying too hard.

The Top Banking Technology Trends that Are Driving the Shift

The tools banks need are already here. The key banking technology trends driving change include:

- Cloud Platforms: For flexibility, scalability, and speed.

- APIs & Open Banking: For partnerships and integration.

- Artificial Intelligence & Machine Learning: For smarter decision-making and automation.

- Blockchain: For secure, transparent transactions.

Keeping up with these banking technology trends isn’t optional – it’s survival.

The Quiet Revolution of AI in Financial Services

When people think of AI in financial services, they picture chatbots. But that’s just the surface.

AI in financial services is transforming:

- How banks manage risk.

- How fraud is detected.

- How loans are approved.

- How investments are advised.

Banks that harness the power of AI in financial services will have a clear edge in both customer experience and operational efficiency.

Final Thoughts: Escalating Competition in Banking Sector is Real

Let’s not sugarcoat it.

The competition in banking sector is fierce.

The banking industry competition is changing faster than most expected.

The banking market trends 2025 are already reshaping the future.

But here’s the good news – this isn’t the end for traditional banks.

It’s the start of a new chapter for those willing to adapt, innovate, and put customers first.

Because in today’s world, it’s not about being the biggest.

It’s about being the boldest.

FinTech is at the center of this banking revolution. From AI-powered lending to digital wallets and open banking, fintech innovations are driving the very trends reshaping financial services today. At Tntra, our Fintech Practice helps banks and financial institutions leverage these disruptive technologies to stay ahead of competition.

Start your journey to real banking transformation today with Tntra.

Schedule a call with our experts! Contact now.

FAQs

What is driving the escalating competition in the banking sector?

The rise of FinTechs, tech giants, open banking regulations, and shifting customer expectations are fueling intense competition in the banking industry.

How are fintech companies disrupting traditional banks?

FinTechs use advanced technology, AI, and digital-first models to deliver faster, seamless, and more personalized financial services, challenging traditional banks.

What are the top banking market trends in 2025?

Key trends include digital wallets, AI-powered lending, green finance, instant payments, and customer-centric experiences shaping the future of financial services.

Why is customer experience critical in banking competition?

Customers now expect personalized, real-time, and frictionless services. Banks that deliver outstanding customer experience gain a competitive advantage over rivals.

How can traditional banks stay competitive against FinTechs and big tech?

Banks can stay competitive by embracing digital transformation, modernizing legacy systems, leveraging data and AI, and partnering with FinTechs for innovation.