Alternative Financial Solutions: The Changing Face of Funding

The need for more convenient access to money among individuals and small businesses is what is causing this growth of alternative financial services. Because of their accessibility and adaptability, alternative financing methods like venture capital, accelerators, crowdsourcing, and angel investors are rising in popularity. This is particularly true for small enterprises, which may have difficulty obtaining capital from conventional financial solutions due to stringent criteria.

Upstart, an AI lending platform created in 2012, collaborates with banks and credit unions to offer consumer loans while predicting creditworthiness using non-traditional factors, including employment status and education. Upstart raised $125 million from various investors over the course of 4 rounds before going public via an IPO.

As a platform for cloud-based AI financing, AI lending makes it possible for customers and lenders to benefit from a superior loan product with enhanced economics. Consumer demand for high-quality loans is gathered by Upstart, which then connects it to its network of AI-enabled bank partners.

Higher approval rates, reduced interest rates, and an entirely digital, highly automated experience are all advantages of Upstart’s alternative FinTech solutions. Bank partners gain from improved automation throughout the loan process, access to new consumers, and decreased fraud and loss rates.

The financial services platform makes use of AI’s capabilities to more precisely estimate a loan’s actual risk. The discrete AI models used by Upstart are designed to combat fee optimization, income fraud, acquisition targeting, loan stacking, prepayment prediction, identity fraud, and time-delimited default prediction.

Source: The Strategy Story

The Growing Demand for Alternative Financial Solutions

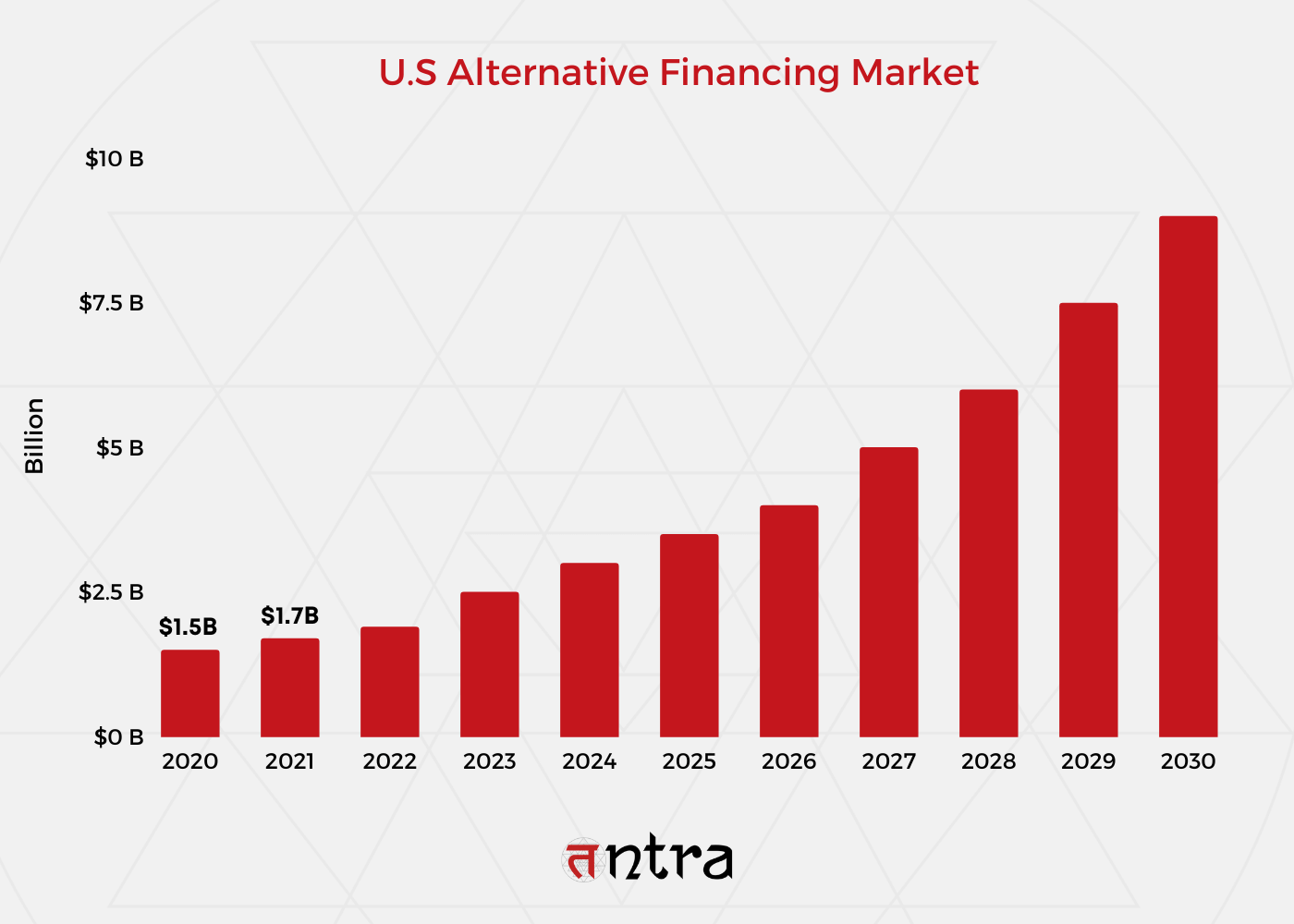

The size of the global alternative finance market was estimated at USD 10.82 billion in 2022, and it is expected to expand at a CAGR of 20.2% from 2023 to 2030. The industry has been propelled by the demand for individuals and small enterprises to have access to cash.

About 40% of respondents to Oracle’s Digital Demand in Retail Banking research of 5,200 consumers from 13 countries believe nonbanks can better help them with their personal money management and investing needs, and 30% of those who haven’t used a nonbank platform stated they’re open to using one of such financial solutions.

According to data provided by SME Finance Forum, there was a $5 trillion funding gap in 2018 between the financial requirements of SMBs and the institution-based financing that was available to them, leading SMBs to look for alternative financial services. According to Credibly’s SMB Forecast Report, 62.5 percent of small businesses turned to alternative funding before looking for a traditional bank loan.

An all-time high of $84 billion was invested in startups by venture capital firms in the US alone in 2018, more than doubling their previous five-year investment.

All the past trends and future analytics predict that alternative lenders are gaining popularity, especially with SMBs. No matter how innovative and passionate the entrepreneurs may be, they have trouble getting finance from banks.

Read more: Redefining FinTech in 2023

Shifting Away from Traditional Financing: The Popularity of Alternative Solutions

In this era of economic change and intense competition, startups need money to adapt and grow. Access to operating capital also becomes crucial for businesses to ensure continuity and customer satisfaction.

Several types of FinTech innovation service providers, ranging from independent private financing partners to small banks and venture-backed technology companies, are developing digital capabilities to address the needs of startups and medium-sized organizations.

Therefore the evolution of the term “alternative financing” refers specifically to a group of financing options, such as debt and venture capital, that close gaps in the established financial markets. This development is part of a broader movement toward financial inclusion, in which more people have access to established lending systems. There are now more options for financing platforms that are supported by companies like Tntra that offer software product engineering solutions.

Due to their versatility and accessibility, alternative financial techniques have emerged and are becoming more popular. Let’s look at some of the reasons behind its popularity –

- Venture Capital and Accelerators

- For startups and high-growth businesses, venture capital and accelerators are alternate financial sources that are gaining popularity. Accelerators give coaching, resources, and financial assistance, whereas venture capital provides financing in return for equity ownership.

- Both approaches enable entrepreneurs to access substantial sums of money without incurring debt and offer beneficial mentoring and networking opportunities that support their expansion and success.

- Crowdfunding and Angel Investors

- Crowdfunding and angel investors are popular alternative financial options for individuals and small businesses. Crowdfunding platforms allow people to raise funds from a large number of individuals for creative projects or products.

- Angel investors, on the other hand, provide financing to early-stage companies in exchange for equity ownership. These options are accessible and less restrictive than traditional bank loans, making them attractive to those who may not have the credit history or collateral to get a loan from a bank.

- Limited Access to Traditional Finance

- Certain people and companies may find it challenging to acquire traditional financial solutions. Due to demanding requirements, including collateral, credit history, and financial statements, small businesses may find it challenging to acquire traditional finance sources.

- This has caused many people and companies to look to alternative FinTechs and technology providers, including crowdfunding websites, peer-to-peer lending websites, venture capital funding, and more.

- Quick Access to Cash

- Due to their shortened application and approval processes, which are frequently quicker than those of traditional lenders, alternative financing methods like crowdsourcing and peer-to-peer lending offer speedy financing. These platforms can offer quicker access to funds because they typically have lower overhead costs and fewer regulatory requirements than traditional lenders.

- Furthermore, platforms for peer-to-peer lending and crowdfunding depend on a sizable number of individual investors who can quickly contribute small amounts of money, which speeds up the borrower’s overall funding.

Discover how Tntra’s Loan Management System helped streamline loan processing and improve customer satisfaction. Explore our FinTech case study now.

Conclusion

Alternative financial solutions are gaining popularity among individuals and businesses, particularly startups and small to medium-sized organizations. These solutions, including crowdfunding, peer-to-peer lending, venture capital, and accelerators, offer quick access to capital, valuable mentorship, and networking opportunities, and increased financial inclusion for those who may not have access to traditional financing options.

With the help of a software product engineering company like Tntra, FinTech providers can offer alternative solutions in the finance space that continue to grow in popularity and availability.

Tntra’s industry solutions are adept at developing alternative FinTech solutions to address the needs of startups and medium-sized organizations.

Contact the Tntra FinTech developers team today.

Listen to our latest podcast episodes on Innovation, FinTech, and more!