How will AI Take Forward the FinTech Industry in Singapore

Table of Contents

ToggleAfter COVID-19, global digital innovation faces evolvement and pressure because of the integration of many new technologies. Artificial Intelligence (AI)-powered solutions are on the rise. The FinTech businesses are going through a 360-degree change, and Singapore is committed to pioneering this sector. The future of AI in the FinTech sector in the coming years will be transformed with smart transactions and real-time transactions taking over. AI-powered solutions will take center stage even in the upcoming Marquee FinTech Festival.

The MAS and Google have signed a memorandum stating they will carry out the financial work by adopting AI. The Monetary Authority of Singapore and Google announced on May 31, 2023, that they would work in the FinTech sector using generative AI. The MAS experts stated they would build state-of-the-art solutions for generative AI applications for the financial industry and internal use.

Google will help MAS technologists improve their AI skills, making Artificial Intelligence adoption seamless and easier. It will help MAS to launch the AI training program for key financial institutions. The use of AI in FinTech market of Singapore will help with smart and real-time transactions. It will help in lowering fraud and cases of money laundering.

New programs will be developed to train people on technologies like AI and data analytics in the FinTech sector. The MAS will design the training program with the training providers and educational institutions. They will provide tailored courses for the financial industry, helping to onboard more experts that are skilled. It will further facilitate improving the FinTech sector using generative AI.

Source: Central Banking

A Quick Analysis of the Future of AI in the FinTech Sector

Singapore has emerged as the biggest innovative hub that offers AI-powered products. It is on the road to development because it attracts investment in robotics, AI, and IoT technologies. The total investment in this market will be around $1.87 billion. Moreover, the government has invested $500 million in AI research and development. Even there is a massive increase in venture capital funding that has reached $4.27 billion in 2022.

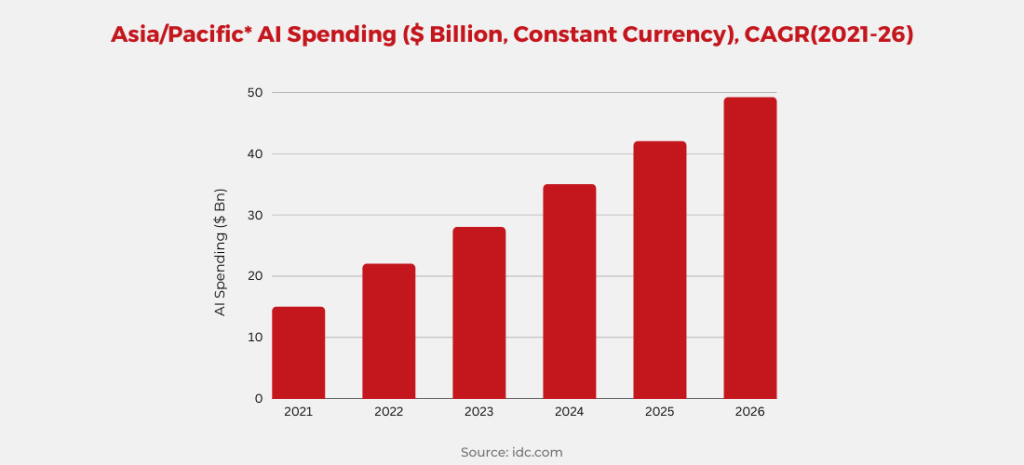

The global adoption of AI in financial institutions is on the rise, with the Asia/Pacific region working on hardware and software related to AI-centric systems. The AI expenditure will grow to $49.2 billion by 2026. It will increase between 2021 and 2026 at a CAGR of 24.5%. The AI-driven innovations will help with improved operational efficiency through an optimized and robust risk management environment. It will further help enterprises to make better decisions regarding this market.

The financial services industry seeks AI-driven technology because it helps with AI-based fraud detection systems. Moreover, the enterprises want to scale their organization as a survey showed that 69% of employees need more energy to do the work. 70% of leaders want to include AI because innovation is lacking. However, adopting AI in a few sectors has made 81% of employees dedicate their work to AI to lessen their workload.

Yahoo Finance reports states that AI in the FinTech sector will be the major theme of Singapore’s FinTech festival. The festival’s main focus will be the growth and adoption of AI and how FinTech methodologies will evolve with this new technology. Elevandi and MAS will organize the FinTech festival in partnership with Constellar. It will be done in collaboration with the Association of Banks in Singapore. This festival’s generative AI venture capital investment will witness a new high of $2.6 billion in 2022.

Role of Artificial Intelligence in the FinTech Industry in Singapore

The fintech companies need AI in Singapore to streamline real-time transactions in the country. Digital transformation is mandatory in the world after the pandemic. FinTech firms in Singapore are taking software product engineering services from reputed companies. As we can see, the investments by venture capitalists on a large scale for adopting AI, the sectors like education, manufacturing, healthcare, etc., are increasingly adopting this technology.

Even the AI tools will help learn customer behavior and provide personalized finance options. It will make the financial investment sector quite lucrative. Moreover, integrating AI-powered chatbots in FinTech would help with seamless customer support.

The FinTech Festival of Singapore also adopted the integration of AI themes. It was to help enterprises acknowledge money laundering activities and frauds happening in the country. Cloud computing and Big Data will be used with AI to support the data processing and analyzing process. The growth in the FinTech industry is possible with Artificial Intelligence, and it will give an edge over traditional FIs. Apart from this, AI will enhance customer relationships by providing real-time financial reporting.

The availability of software product engineering solutions for the FinTech industry will help integrate third-party apps and advanced technology. AI will help you make accurate decisions, and claim processing will also be quick.

Transform your loan management with Tntra’s innovative platform. Enhance efficiency and customer experiences. Read more now!

Partner with the Right FinTech Solution Provider!

The FinTech industry is evolving as it uses advanced technologies to handle customers, detect frauds, handle claims, etc. Using AI in Singapore’s banks and financial institutions will make things organized. You can get software solutions for your FinTech organization from a reputed software product engineering company, Tntra. We have a team of dedicated experts to help you with industrial digital transformation with smart alternatives.

Contact the experts at Tntra today and discuss the plan for your next FinTech software development needs.