5 FinTech Problems that May Drive Customers Away

Table of Contents

ToggleThe challenges in Fintech can repel customers. The challenges include underfunding, inadequate data protection, economic downturns, and more. To overcome these challenges, FinTech companies must prioritize user experience, privacy and data protection, financial stability, and compliance from the beginning.

Wonga was an online payday loan company based in the United Kingdom. It was established in 2006 and started providing short-term loans with high-interest rates through online applications in 2007. However, due to problems in the FinTech company, it wrapped up its business in 2018.

Wonga was a unique player in the British lending market, offering customers access to short-term loans through its technologically advanced platform. Wonga utilized advanced decision technology and risk-modeling techniques. This allowed the FinTech innovation company to automate its lending process, reducing the time and effort required to approve and disburse loans. In addition, Wonga’s use of technology-enabled it to quickly assess the creditworthiness of applicants and make informed lending decisions, which ultimately improved the loan experience for its customers.

Unfortunately, due to the company’s AI lending money to individuals unable to repay their loans, many loans had to be written off. As a result, approximately 330,000 clients had their loans canceled, and an additional 45,000 clients had their fees and interest payments were waived.

The Financial Conduct Authority (FCA) also became involved following a scandal in which Wonga sent false letters of demand to customers who were behind on their payments, and the company was ordered to pay £2.6 million in compensation. Eventually, Wonga shut down its operations in 2018.

Source: Finty

Challenges in FinTech App Development

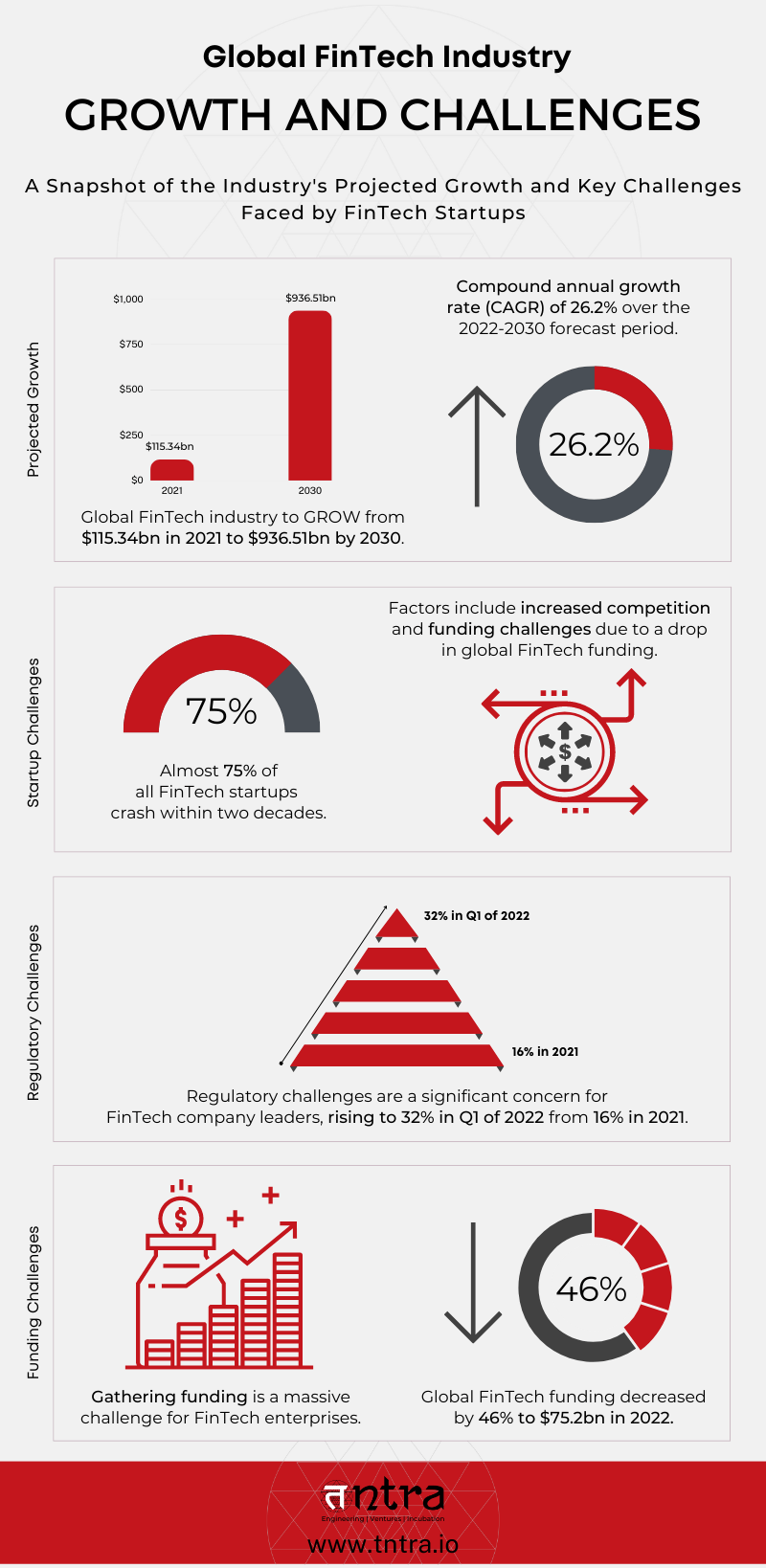

According to The Brainy Insights, the global FinTech industry is projected to grow from $115.34 billion in 2021 to $936.51 billion by 2030, with a compound annual growth rate (CAGR) of 26.2% over the 2022-2030 forecast period.

However, the industry’s growth only guarantees success for some FinTech companies. Almost 75% of all FinTech startups crash within two decades. There are several factors behind the failure of these FinTech startups, some of which are listed below –

- The global count of FinTech businesses has increased from approximately 12,000 in 2019 to over 26,000. The rise in FinTech enterprises has raised challenges in FinTech due to increased competition.

- According to the FinTech in 2022 survey by Alloy and Gartner Peer Insights, the biggest concern for FinTech company leaders rose to 32% in Q1 of the year, with regulatory challenges being the main threat. This is a significant increase from the 16% reported in 2021. This is among the main challenges faced by FinTech app development services.

- Gathering funding is a massive challenge for FinTech enterprises. CB Insights’ 2022 State of FinTech Report shows that global FinTech funding decreased by 46% to $75.2 billion in 2022. It is crucial to examine the reasons behind this drop in funding and the impact it could have on the FinTech industry’s growth and development in the future.

Top 5 FinTech Problems to Drive Customers Away

1. Underfunding

- There needs to be more funding to be cited for the failure of a FinTech app development company. Often, these companies only realize they need more funding after struggling.

- Management may need to be aware that securing funding takes time, creating cash flow pressure and shortening their runway. As a result, many startups need more money during the funding gap, leading to their closure.

2. Data Protection Problems

- One of the biggest challenges in FinTech industry is inadequate data protection can lead to user dissatisfaction and, ultimately, the deletion of your FinTech application.

- If financial information is mishandled in addition to personal information, the backlash could be much more severe. Therefore, addressing privacy challenges from the outset of developing your FinTech application is crucial to ensure user adoption.

3. Economic Downturn

- FinTech companies often require significant external capital to establish themselves in the market and achieve long-term growth. However, economic downturns can pose a challenge to these companies as investors may withdraw funding during times of financial uncertainty.

- If the investors decide to pull out their funding, it can leave the FinTech enterprises struggling to secure additional capital promptly. As a result, the company may face a shortage of funds, be unable to continue operations, and eventually be forced to shut down.

4. Intimidating Nature of Finance

- FinTech can be overwhelming, especially for non-tech-savvy people, as it combines finances and technology, resulting in FinTech hesitancy as a significant challenge for tech companies. Therefore, a software product engineering company must create an exciting and interactive tool that customers can easily use and enjoy.

- Cold and impersonal traditional banking experience on your FinTech app may discourage potential customers from downloading your platform.

5. Compliance Problems

- Next, the FinTech problem statement about the issue of regulations such as various financial laws, regulations, and operational requirements. However, some startups may need to pay more attention to compliance issues and only hire compliance officers at later stages.

- This oversight can lead to non-compliance and regulatory violations, which can result in the shutdown of the FinTech company by authorities. Therefore, it’s essential to prioritize compliance from the beginning to avoid legal and regulatory challenges.

👉 Explore our Fintech Practice: https://www.tntra.io/fintech-practice

Conclusion

Several FinTech problems can drive customers away. These include underfunding, inadequate data protection, economic downturns, fintech hesitancy, and compliance problems. To avoid these issues, a FinTech app development solutions company should prioritize user experience, privacy and data protection, financial stability, and compliance from the outset.

Doing so can build trust with their customers and foster growth in a competitive and ever-evolving FinTech industry. FinTech innovation companies that prioritize these factors and address the challenges will be best positioned to succeed in the long term.

Tntra FinTech is primed to help you build a cashless ecosystem that nurtures your enterprise’s future growth and stability.

Contact Tntra today for FinTech application development needs.

Listen to our latest podcast episodes on Innovation, FinTech, and more!