The Role of Technology Consulting in FinTech Innovation

Technology consulting firms are at the forefront of the FinTech revolution, employing AI, ML, and Blockchain to drive innovation. They strategically align technology with business objectives, ensuring sustainable growth. By guiding in the selection of scalable technology stacks, they pave the way for long-term success. Additionally, user-centric design is prioritized, enhancing overall customer satisfaction. Embrace the FinTech revolution and elevate your financial services with the expertise of technology consulting firms, promising secure, efficient, and customer-centric solutions.

In the UK, the FinTech landscape is thriving, boasting over 1,600 firms employing a workforce of 76,500. These dynamic companies are revolutionizing conventional banking practices through cutting-edge innovations, driving rapid sectoral expansion.

Barclays has long recognized the pivotal role of collaborating with financial services startups, particularly those aligned with the bank’s expertise. Barclays has identified and supported promising startups through strategic investments and partnerships, reaping mutual benefits. Noteworthy collaborations include ventures with FinTech players like Flux, a digital receipt company, and MarketFinance, a financial solutions and invoice firm. These alliances not only helped grow the startups but also infused Barclays with novel technologies and services.

Engaging with FinTech firms injects a breath of fresh ideas into Barclays’ operational framework. It harmonizes with the bank’s internal focus on advancing FinTech software development and investing in technology to enhance its offerings. Moreover, it addresses prevalent challenges within the broader industry. Acknowledging that they don’t possess all the answers, Barclays values FinTech startups for their potential to offer innovative perspectives and solutions for existing and future hurdles.

The collaboration not only elevates the technological landscape but also fosters an environment of continuous learning and innovation, positioning Barclays at the forefront of the evolving financial services industry. Through strategic investment and through the help of technology consulting services, Barclays continues to pioneer FinTech advancements, ultimately benefiting the bank and its partnered startups.

Source: Barclays

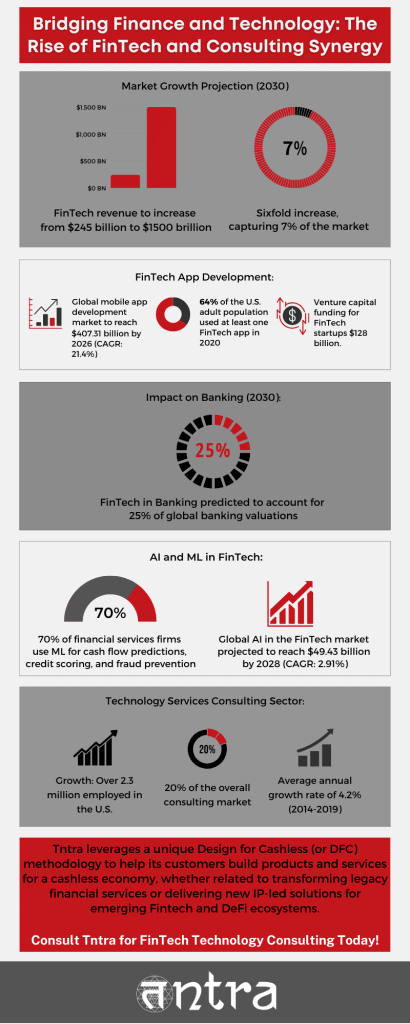

The Transformative Power of FinTech Innovations

The financial industry will see a seismic shift because of the FinTech revolution. According to a recent Boston Consulting Group (BCG) and QED Investors analysis, financial technology revenue is expected to climb from $245 billion to an amazing $1.5 trillion by 2030, a spectacular sixfold increase. A 2% portion of the $12.5 trillion in annual worldwide financial services revenue is currently controlled by the FinTech industry. However, this is expected to change dramatically since the FinTech sector is predicted to hold up to 7% of the market. Notably, banking FinTechs are predicted to play a crucial role; by 2030, they may account for about 25% of all banking valuations globally.

The technology services consulting sector, including IT and technology consulting, has experienced substantial growth, employing over 2.3 million people in the United States alone. This field accounts for roughly 20% of the overall consulting market and demonstrated an average annual growth rate of 4.2% between 2014 and 2019. Furthermore, the assistance of a FinTech app development company is poised to impact this dynamic industry landscape significantly.

A software product engineering company like Tntra holds the expertise to empower FinTech enterprises by leveraging the immense potential of Artificial Intelligence (AI) and Machine Learning (ML). Recent findings from Deloitte Insights indicate that 70% of financial services firms utilize ML to enhance cash flow predictions, refine credit scoring, and combat fraud. Moreover, the Economist Intelligence Unit’s research highlights that 54% of Financial Services organizations with 5,000+ employees have embraced AI. With the global AI in FinTech market projected to reach $49.43 billion by 2028, at a steady CAGR of 2.91% (2023-2028), Tntra is poised to play a pivotal role in engineering top-tier FinTech applications.

A specialized FinTech app development solutions company holds the expertise to assist financial sector enterprises in crafting top-tier applications. With the global mobile app development services market projected to surge from USD 106.27 billion in 2020 to USD 407.31 billion by 2026 at an impressive CAGR of 21.4%, the demand for innovative FinTech solutions is evidently on the rise. In 2020, a significant 64% of the US adult population utilized at least one FinTech app, highlighting the widespread adoption. Moreover, with venture capital funding for FinTech startups reaching a staggering $128 billion, the potential for groundbreaking applications in this sector is substantial. Across the globe, a noteworthy 77% of individuals now rely on their mobile phones for payments, underscoring the pivotal role of mobile technology in financial services. Among Gen X, more than 90% express enthusiasm towards mobile banking and fintech apps.

FinTech app development services play a pivotal role in driving the digitization agenda for financial sector companies. They leverage cutting-edge technologies like AI, ML, blockchain, and data analytics to revolutionize financial services. With a proven track record of successful implementation, these firms empower FinTech enterprises to enhance efficiency, security, and customer experience. As the FinTech revolution continues to reshape the industry, the expertise of technology consulting firms becomes indispensable in navigating and capitalizing on this transformative journey towards a digitally-driven financial landscape.

Empowering FinTech Ventures through Expert Technology Consulting Services

A technology consulting company assists financial sector enterprises in devising a strategic roadmap. This involves meticulously assessing business goals and in-depth analysis of prevailing market trends. By harmonizing technology solutions with these crucial aspects, consulting firms ensure that the FinTech venture is poised for sustainable growth. This strategic alignment provides a clear trajectory for development and establishes a framework for ongoing evaluation and well-informed decision-making.

Selecting the right technology stack is critical for any FinTech startup, and technology consulting services excel in providing expert guidance in this world. Armed with comprehensive knowledge of the latest technologies, they assess how each component integrates into the FinTech ecosystem. Working closely with startups, they consider scalability, security, and long-term viability factors. The choice of a technology stack that is both scalable and secure forms the bedrock for the success of the FinTech application. It ensures that the technological infrastructure can evolve in tandem with the business, facilitating seamless expansion and service augmentation.

Technology consulting companies leverage cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), and Blockchain to drive innovation within FinTech. These firms empower FinTech applications to deliver personalized and data-driven solutions by integrating AI and ML algorithms. This translates into enriched user experiences, precise financial insights, and streamlined process automation. Furthermore, including Blockchain technology ensures secure and transparent transactions, a critical feature in the financial services sector.

Consulting firms also give precedence over designing intuitive interfaces and seamless interactions to elevate customer satisfaction. Through a user-centric design approach, they guarantee that FinTech applications are functionally robust and user-friendly, furnishing an intuitive experience that fosters trust and loyalty among users.

Unlock the future of real estate lending with our cutting-edge Inspection Platform. Read more now!

Conclusion

The synergy between FinTech innovations and expert technology consulting services reshapes the financial industry. By aligning strategic roadmaps, optimizing technology stacks, and harnessing cutting-edge technologies like AI and Blockchain, these collaborations drive efficiency, security, and enhanced user experiences. This transformative journey towards a digitally-driven financial landscape underscores the indispensable role of technology consulting firms such as Tntra in navigating and capitalizing on the FinTech revolution.

Transform your FinTech venture with Tntra. Contact us now!