Singapore’s Digital Payment Revolution: Trends and Innovations

Table of Contents

ToggleSummary

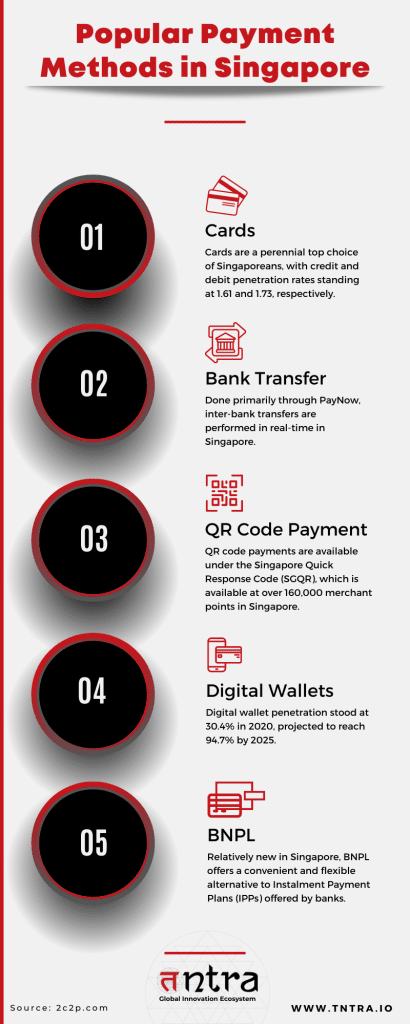

Real-time transactions, QR payments, and smart wallets are all part of Singapore’s embrace of the digital payment revolution. Cards continue to rule the market as the preferred form of payment, but QR codes and contactless payments are also becoming more and more popular. Singapore’s commitment to digital transformation is clear through the incorporation of cutting-edge technologies like AI and blockchain.

Singapore’s Cashless Revolution: How FOMO Pay is Driving Digital Transformation in Payments

With a startling 75% internet penetration, Singapore adopted 5G technology early on. The country is a significant player in the tech-savvy world thanks to its familiarity with mobile and alternative payment methods, demonstrating its proficiency in harnessing digital transformation strategies in banking, finance, and payments.

With the help of FOMO Pay, banks and businesses may now accept various payment options, including NETSPay, mVISA, Grab Pay, WeChat Pay, Singtel Dash, RazerPay, and more. Since its 2015 introduction, FOMO Pay has gained popularity quickly, adding over 7,000 retailers in just one year. Reputable companies rely on the services of FOMO Pay, including SPH, Marina Bay Sands, StarHub, JUMBO, Club 21, and CHANEL.

By utilizing FOMO Pay, businesses can fully realize their potential by offering clients the payment methods they choose and supporting the adoption of cashless transactions. To promote QR code payments and make Singapore a cashless society, FOMO Pay is actively involved in the MAS SGQR Taskforce. By utilizing FOMO Pay and other services such as 2C2P, Liquid Group, CardUp, and more, businesses in Singapore can embrace the payments revolution.

Source: Inai, IBS Intelligence

The Digital Transformation Journey of the Payments Sector in Singapore

The Singapore payments market is anticipated to grow significantly between 2022 and 2027, with a CAGR of 7.5%. Real-time payments are becoming more common, and government programs to promote digitization are expected to accelerate transformation in payments and, thus, the industry growth.

In Singapore, where card payments now account for 97% of all transactions, cash payments have lost ground as the preferred means of payment. According to Visa’s Consumer Payment Attitudes Study, over 95% of customers across generations prefer using credit and debit cards. This change is largely due to the widespread use of contactless cards, which 82% of Singaporeans use for various transactions, including purchases at convenience stores (54%), stores for general retail, and supermarkets (52%).

Furthermore, 35% of people prefer to pay their bills online with a credit card. The convenience and acceptance of contactless cards, which drive this trend, represent Singapore’s continuous progress towards digital transformation solutions to become a cashless society.

PayNow, a well-liked real-time payment system in Singapore, facilitates smooth inter-bank financial transfers between ten banks and four Non-Bank Financial Institutions (NBFIs). PayNow is accepted by at least 80% of residents and businesses, with individual registrations increasing by 1.6 million and business registrations increasing by doubling in 2020. As per a report, with 138.38 million more transactions (a 48% increase) and a 40% increase in transaction value (US$154 billion) in 2020 compared to 2019, it has considerably aided the growth of real-time payments.

The Singapore Quick Response Code (SGQR), introduced by MAS in 2018, combines 27 payment QR codes into a single label, easing payment procedures for customers and businesses. According to a 2021 Statista study, a sizable 36% of respondents, QR code payments are increasingly common in Singapore. The use of QR code payments has been made simple and widely accepted in the nation thanks to the installation of SGQR.

Additionally, digital wallets have increased significantly in Singapore, going from 30.4% in 2020 to a predicted 94.7% by 2025. In a survey commissioned by 2C2P, IDC estimates that 1.5 million people will use mobile wallets in 2020. Mobile wallets are predicted to increase over the coming years, with 3.2 million users by 2025.

The Digital Payment Revolution in Singapore

Due to the rising use of digital payment methods by e-commerce platforms and suppliers, made possible by mobile payment apps like CashApp, Venmo, PayPal, etc., the digital payments market in Singapore has experienced significant growth. Due to this, PayTechs—which comprise 25% of all FinTechs and focus on different facets of the payment value chain—have emerged.

- Huge Marketplace

- In Singapore, physical outlet purchasing has decreased due to the COVID-19 pandemic. However, online shopping through various channels has increased.

- With 65% of Singaporeans trying it out and 18% making purchases, live-stream buying has become a huge e-commerce trend. Over 300,000 hours of live streaming took place on platforms like Shopee’s 11.11 sale.

- The world has the potential to transform into a digital marketplace as more and more aspects of daily life incorporate digital connections. For both customers and merchants, seamless technology consulting solutions that create a smooth payment experience are crucial since it makes hassle-free checkout possible with just a tap or click.

- Card Payments

- Cards dominate the digital payment landscape in Singapore, with nearly 7.7 million in circulation. NETS payments and bank transfers follow closely behind. E-wallets such as Apple Pay and Google PayTM are gaining popularity, along with the rise of contactless transactions.

- According to Global Data’s 2022 research, credit cards are the preferred method for online and mobile purchases. Software development companies in Singapore play a crucial role in enabling the growth and innovation of digital wallets, projected to reach a penetration rate of 30.4% in 2021.

- QR Payments

- Due to its convenience and simplicity, QR payments have become extremely popular in Singapore as the preferred digital payment option. Consumers can conveniently and securely make purchases without using cash or credit cards by utilizing a scanning app on their cell phones.

- Because QR codes are interoperable, transactions across various payment providers can be completed quickly and easily, increasing accessibility. These initiatives underscore the significance of digital transformation services in driving the integration of QR payments and further advancing Singapore’s journey toward a cashless economy.

- Use of Emerging Technologies

- Singapore has established itself as a major center for financial technology innovation. The Monetary Authority of Singapore (MAS) has designed and developed regulatory sandboxes to promote testing with cutting-edge technology like blockchain to boost security and transparency in financial systems.

- The National AI Strategy of Singapore also encourages using AI-driven service across numerous industries. The approach is focused on advancing AI capabilities, encouraging research partnerships, and ensuring AI is used morally and responsibly. These programs aid Singapore’s continuing digital services ecosystem of its financial, healthcare, transportation, and other sectors.

- Smart Cities and the Internet of Things (IoT)

- With the goal of enhancing the lives of its residents, Singapore is at the forefront of creating smart cities by utilizing IoT technologies. By compiling data from numerous sources and facilitating real-time monitoring and informed decision-making, the Smart Nation Sensor Platform (SNSP) is essential to this endeavor. Incorporating IoT devices into urban infrastructure offers prospects for cutting-edge payment solutions for transforming financial services.

- Transactions in public services can be expedited by IoT-enabled payment systems, resulting in optimum resource allocation and providing a smooth and effective payment experience. As this illustrates, software product engineering services are driving the change in financial services in Singapore’s smart cities.

Streamline your loan management with Tntra. Read case study now!

Conclusion

Singapore’s digital payments market has witnessed significant growth, driven by the adoption of innovative technologies and the government’s initiatives to promote a cashless society. The emergence of PayTechs and the increasing popularity of digital wallets, QR payments, and real-time transactions have reshaped the payments landscape.

As the country continues its digital transformation journey, the role of software development companies in Singapore becomes crucial in providing cutting-edge solutions and enabling the seamless integration of digital money or digital currency.

The future of payments in Singapore holds great potential, with technological advancements poised to transform the nation into a thriving digital marketplace.

Please reach out to Tntra, a prominent fintech software company renowned for their exceptional FinTech application development services in Singapore.