Creating Economic Opportunity with New Economy and FinTech

New Economy and FinTech companies are creating economic opportunities by using technology to provide access to financial services and products. New economy companies and FinTech solutions such as Neobanks and mobile payment applications are providing more affordable and efficient banking services to undeserved populations.

Lending Club is amongst the New Economy companies that work at the cutting edge of technological innovation. The online company matches people who want to borrow money with others willing to lend it. In just eight years of FinTech innovation, the company has gone from birth to IPO while arranging $7.6 billion in financing.

Lending Club is a recent financial disrupter focusing on startups and other small businesses. It has become a strong alternative to online lenders and traditional banks that make it hard for small entrepreneurs to manage funds.

Lending Club also offers a variety of loan products, including personal loans, small business loans, and medical financing, which allows borrowers to find the loan product that best suits their needs. With no physical branches, a stash of capital for giving out, and reserves for meeting losses, Lending Club acts as an intermediary making money through fees.

The company also offers a variety of loan products, including personal loans, small business loans, and medical financing, which allows borrowers to find the loan product that best suits their needs. The FinTech application underwrites and prices each loan and detects fraud. Most of the loans are never examined by humans.

Overall, Lending Club has made it easier for small businesses and individuals to access credit and funding by providing a more efficient, transparent, and accessible loan application process, increasing the chances of obtaining a loan, and offering various loan products to suit different needs. This stimulus to small businesses has helped to push the economy in the right direction.

Global FinTech Adoption for Financial Inclusion

According to the World Bank, in 2017, more than 1.7 billion adults worldwide remained unbanked and unable to access traditional financial services. FinTech product engineering solutions and services can potentially increase access to financial services and promote financial inclusion for these individuals.

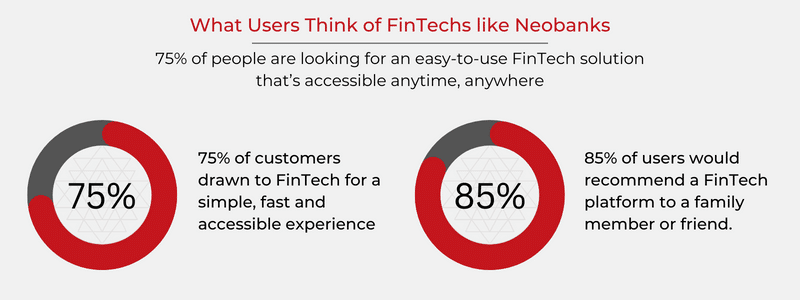

NeoBanks is the latest innovation in the New Economy model. The global Neobanking market is presently valued at approximately $66 billion USD. It is expected to exceed $2 billion USD by 2030. Neobanks have lower fees and an easy interface for a good user experience. Neobanks are also helping to increase financial inclusion by providing banking services to people previously excluded by traditional banks. The global transaction value in the Neobanking segment is projected to reach US$4.53tn in 2023.

FinTech software development solutions can help and support marginalized farmers in ways that generate welfare and economic growth. According to a 2017 Asian Development Bank 2017 report, New Economy industries engaged in the lending business could use digital payment systems to meet 40% of the unmet need for payment services and 20% of the credit needs. The New Economy Agri-fintech enterprises can assist in increasing the GDP growth in small countries like Indonesia and the Philippines by 2%–3% per year.

How are New Economy and FinTech Creating Economic Opportunities Globally?

New Economy and FinTech are creating economic opportunities by using technology to provide financial services and products in more efficient and accessible ways. As the world is moving closer to community-driven and cashless transactions, a software product engineering company can enable businesses to adopt cutting-edge platforms.

Some of the critical ways that New Economy and FinTech are creating economic opportunities include:

- Financial Inclusion:

- FinTech companies are using technology to provide financial services to underserved populations, such as those without access to traditional banking. This increases access to financial services and promotes financial inclusion, which can lead to increased economic empowerment and growth.

- FinTech enterprises use mobile technology to provide individuals and businesses with access to digital financial services, such as mobile payments and digital banking. In addition, they use technology to enable microfinance services, such as small loans and savings accounts.

- Digital Skills:

- FinTech and New Economy companies also require employees with digital skills, such as data analytics, artificial intelligence, and software development, leading to an increase in job opportunities for professionals with these skills.

- One of the main benefits of the New Economy is that it forces people to learn new skills for leading high-paying jobs. New Economy models drive AI/ML, Blockchain tech, and other digital skills. In addition, the demand and need for relevant skills are becoming necessary due to remote working models, the rise of entrepreneurship, and the continuous change in the New Economy.

- Innovation:

- FinTech companies use technology to create new financial products and services, such as digital currencies and online lending platforms. This can lead to increased competition in the financial sector and drive innovation, leading to increased efficiency and lower costs.

Checkout our Success Stories of Loan Management System Case Study

Conclusion

New Economy and FinTech promote financial inclusion, increase access to financial services, drive economic growth, and create new job opportunities. New economy platforms, such as online marketplaces developed by software product engineering consulting firms such as Tntra, coupled with a sharing economy, have made it easier for small businesses to reach customers and monetize assets.

At the same time, FinTech companies like Neobanks and microfinance institutions are providing more affordable and efficient banking services to underserved populations. Additionally, a FinTech app development company such as Tntra can introduce new features such as budgeting tools, cashback, and rewards programs, which traditional banks may not offer. Furthermore, FinTech is also promoting the use of new skills such as digital skills, automation, remote work, entrepreneurship, adaptability, and continuous learning, which is crucial in today’s job market.

Overall, the New Economy and FinTech have the potential to drive economic growth and improve people’s lives. Tntra FinTech and New Economy solutions are driven by cutting-edge technology. We leverage a unique Design for Cashless (or DFC) methodology to help its customers define and build products and services for cashless transaction environments.

Contact team Tntra today for FinTech and New Economy application development.